An appraisal report is a document that provides an unbiased and professional opinion of a property's value. Appraisers execute a thorough analysis of the property, taking into account factors such as its location, size, condition, and recent transactions in the neighborhood. This information is then utilized to estimate the property's fair market value.

Appraisal reports are often required for various purposes, including mortgage applications, estate planning, and property issues. They offer valuable insight into the existing worth of a property, which can be helpful for both buyers and sellers.

Understanding the check here key components of an appraisal report can empower you to make more informed decisions about real estate purchases.

The Role of Appraisers in Real Estate Transactions

In the intricate world of real estate transactions, appraisers play a pivotal/essential/crucial role. These qualified professionals provide an objective/unbiased/neutral assessment of a property's appraised price, serving as a reliable source of information for both buyers and sellers.

Their expertise/knowledge/valuations are often sought out by lenders to ensure/verify/confirm loan amounts/values/terms and help mitigate risk. Moreover, appraisers contribute to the smooth closing process by providing a clear/transparent/concise understanding of a property's market standing.

This assessment/evaluation/opinion of value can have a significant/substantial/profound impact on negotiations/decisions/outcomes, ensuring that both parties involved in a real estate transaction are well-informed/fully aware/properly guided.

Factors Shaping Property Value: An Appraisal Perspective

An appraisal is a meticulous examination of real estate characteristics to determine its market value. Several key factors contribute to this valuation, influencing both the assessment a property fetches and its overall attractiveness. Location, clearly a paramount factor, encompasses proximity to amenities, schools, transportation infrastructure, and the overall atmosphere of the neighborhood. Property characteristics, such as size, layout, age, and amenities, also play a significant role. Market conditions, including supply and demand, interest rates, and economic trends, exert a powerful effect on property values.

Finally, the condition of the home itself is crucial.

A well-maintained, updated property commands a higher worth than one requiring significant repairs or renovations.

Appraisers leverage their expertise to meticulously analyze these factors, providing a detailed valuation that reflects the true market assessment of a property.

Valuation Strategies

In the realm of finance and real estate, assessing assets is a crucial process that determines their fair value. Various approaches are employed to arrive at an accurate appraisal, each with its own strengths and limitations. Typically used methods include the sales comparison, the building cost method, and the investment return method.

- Traditionally, appraisers rely on in-depth market research to compare similar properties that have recently transacted. This approach provides a basis for determining the present value of the subject property.

- Alternatively, the cost approach considers the construction costs of a similar property, taking into account factors such as land value, building materials, and labor. This method is especially rare properties where comparable sales data may be unavailable.

- Finally, the income capitalization method focuses on the property's income-generating capacity. It determines the present value of future income streams, using a discount rate that reflects market conditions and investment potential.

Ultimately, the choice of appraisal method depends on the details of the property being evaluated, as well as the goals of the appraisal. A qualified appraiser will meticulously consider all relevant factors to provide a reliable estimate of value.

Ethical Considerations for Appraisers

Appraisers possess a position of trust within the real estate realm . Its professional conduct is imperative to ensuring impartiality in property valuations. Therefore , ethical principles are critical for appraisers to copyright . Various the key concerns include maintaining independence, abstaining from conflicts of interest, and conducting due diligence. Appraisers must remain abreast of industry regulations and follow them strictly .

Additionally, transparency and sincerity are crucial in all dealings with clients, lenders, and other stakeholders . By adhering to these ethical imperatives , appraisers foster a fair real estate system .

Navigating the Appraisal Process

Appraisals can appear like a complex and challenging process, but with some knowledge, you can smoothly navigate it. First understanding the purpose of an appraisal: to determine the fair market value of your property. This will help you define realistic goals and anticipate the procedures.

Once, it's important to opt for a qualified appraiser. Look for someone who is certified and has experience in your region. You can often obtain recommendations from real estate agents, lenders, or family.

When the appraiser arrives, be sure to share them with all necessary information about your property. This includes updates, nearby transactions, and any characteristics. Be responsive throughout the process, as this will speed up the appraisal assessment.

Rick Moranis Then & Now!

Rick Moranis Then & Now! Keshia Knight Pulliam Then & Now!

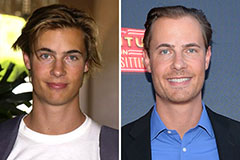

Keshia Knight Pulliam Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now! Batista Then & Now!

Batista Then & Now!